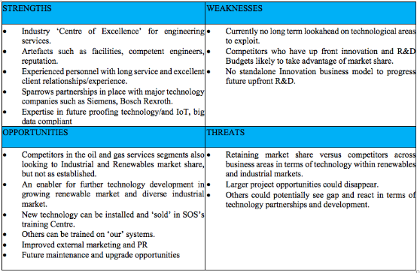

SWOT Analysis on Sparrows Offshore Services Ltd (2020), Brian McRitchie.

Above is an extract from a SWOT analysis I undertook on my organisation in 2020. Carrying out a similar exercise on the Oil and Gas Industry, in particular Innovation and Technology, as a whole, shows similar outcomes.

Oil and Gas Industry -Innovation and Technology as they move through the Energy Transition

STRENGTHS:

The oil and gas industry was renowned for having the budgets and resource to carry out some amazing innovation and technological developments in order to extract oil and gas. These range from structural engineering (oil platforms), Electronics and electrical engineering (Automation and control systems for safety and operation of valves), Hydraulic and pneumatics.

The industry was (and is starting to become again) a culture of innovation and has some amazing talent with artefacts such as the premises, resource, training regimes and ability to deliver some amazing innovation as we transition away from fossil fuels.

The effort and enthusiasm that was originally put into early technology (1970’s and 80’s) to allow the extraction of oil is now starting to be seen in the transition to renewable and cleaner technologies.

Innovation in the oil and gas industry

The oil and gas industry are a very well-established industry which still has the workforce and skills needed to do well in the transition to other technologies. This also extends to partnerships and alliances, which, especially if engineering biased, can be used to investigate the next generation of technology needed.

My Organisation therefore need to update their engineering delivery process to allow for these new technologies and partnerships rather than using the older processes in force that were generated some 10-15 years earlier.

WEAKNESSES:

Due to a number of downturns and the global pandemic, where oil prices have dropped as low as $20 per barrel (2002, 2009, 2015 and Mar 2020) where profit making is difficult and investment in technology not seen as a priority, investment in technology has been slow since 2009. Now that we are back in the $85 a barrel region, investment is started to creep back and interested gained. This has spawned a culture that has been difficult to remove and so investment in up-front R&D difficult to gain access to.

https://oilprice.com/oil-price-charts/

https://www.macrotrends.net/1369/crude-oil-price-history-chart

‘A clear correlation between innovation and success in growing revenues across industries’

Innovation in the oil and gas industry

With this in mind my organisation will need to include technological and innovation as part of their long-term ambitious growth strategy and ensure business models and processes reflect this, especially as we venture into new territory. Current processes are more than 10 -15 years out of date.

Other, smaller companies are also encroaching into territory that my organisation were used to being the ‘go-to’. These smaller companies, with upfront R&D and associated delivery processes are able to compete by delivering more cost effectively.

https://maritimedevelopments.com/news/mdl-ame-awarded-crane-upgrade-scope/

OPPORTUNITIES:

My organisation has done the right thing and looked at the Industrial and Renewables sectors as future revenue streams, rather than complete reliance on the Oil and Gas Sector. As a result, there are numerous opportunities in the following fields:

Nuclear:

Currently my organisation has bid and are starting to win future contracts for electrical engineering work on nuclear power station sites and Nuclear Submarine Bases for the MOD.

MOD:

Work on crane automation and control systems within Royal Navy bases to support build and refurbishment programs on Royal Navy Submarine and Warships. Also numerous other electrical, hydraulic and mechanical engineering works.

Industrial Factories

Numerous factory automation opportunities exist within the food and drink industries on their automated factory floors.

Cable and Pipe Lay Systems:

Numerous engineering tensioner system rental for the installation and extraction of offshore and onshore windfarm power cables.

Renewables:

Numerous opportunities in windfarm blade inspections and electrical work.

To exploit these opportunities, my organisation needs to invest in R&D, partnerships and acquisitions with an Engineering deliverable process to suit that does not involve 100% in-house development.

Sparrows Offshore Services Marketing Mix 2020

THREATS:

As a result of smaller companies becoming competitors (oil and Gas sector) and the fact that my organisation is moving into sectors that will already have a long-established set of servicing companies, our market share could be jeopardised if we cannot deliver efficiently, which using our current out of date engineering delivery process, could cause reputational damage if not careful. These need to be changed to take int account R&D and the use of a ‘coupled approach’ (Gassmann and Enkel, 2004, p. 13)

Other threats could again be the economy and also the possible saturation of the very market share we are trying to exploit, as others also go through the energy transition.

My organisation also have a number of influencers within the engineering departments who have worked within my organisation for 15 – 20 years plus. This has cultural difficulties within the organisation where ‘change’ is difficult to gain buy-in, especially by these very people who wrote the original (now out of date) processes.

Comments

New comment

Great depth to your detail here Brian I hope this is creating a foundation for understanding the need change here many thanks Joanne Pearson