Overview

We are reminded this morning by the mainstream media that the Office of National Statistics has published the beautifully annotated labor market report on UK unemployment figures, showing how the rate for unemployment has spiked.

Now, in the mainstream New Keynesian DSGE model, unemployment is very nuanced. Why would I use this exact word? Well, because there are several ways of perceiving how economic factors can control firm-wide behaviour, where less endowed firms respond to higher inflation and higher wage demands. I would argue the UK is a very good example of how real rigidities permeate the economy because of the impromptu nature of central government actions taken to boost tax receipts, such as hikes in employer national insurance contributions.

UK Unemployment - The OBR's Onus

It is not rocket science and it is really not as it seems or as many would have you believe. ONS figures are not reflective of personal circumstance. Far from it. When, at any one time, unemployment rises to meet the effects of inflation expectations and firm de-hiring/separation decisions, this happens to new workers. The accusation of laziness or idleness as a reason is therefore not suitable to describe the effect in the data. Furthermore, if we examine the ONS data closely, we may find that the proportion of workers who are captured by long-term unemployment is lower than that of those who have been active in the most recent past. I am 95% certain of this.

Odd Levers and Some Proverbial Economic Analysis

We are led to believe the New Keynesian Phillips Curve has expired as a means of analysing inflation and unemployment dynamics. Influential actors close to the BoE, who are effectively authorities, such as Andy Haldane and Dave Ramsden, after him, have each mentioned this. But I don't bring up the subject because it's empirically fictional, or because the data seems to reject its assumptions, I bring up the subject because it's very, as I say, nuanced to view unemployment in isolation without critiquing the model of macroeconomic policy, which officials in His Majesty's Government and the country's independent central bank choose to advocate for. Side effects of medication often surface when a patient is recuperating from an illness, not during periods of relative good well-being.

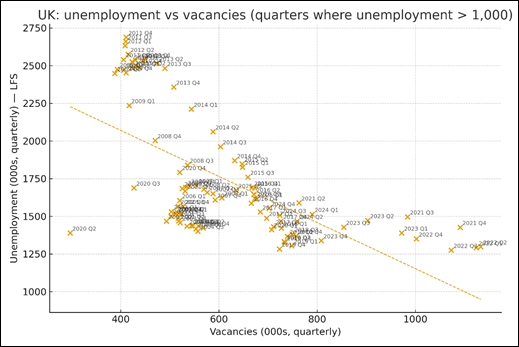

It is therefore in the interests of the Office of Budget Responsibility's badged economists and civil servants acting as economic experts to view this eventuality as a phenomenon in an integrated, broader way, one which takes into account the UK's vacancy rate, its level of interest rates, and employer contributions. The idea that BOE's Governor Bailey has overcooked things by keeping rates on ice is one that I am fond of.

In my discussions about the Employment Rights Bill, I have always remained somewhat optimistic that reducing barriers towards entry to work (which is different from creating access for the unemployed) can be an action that reduces the economic implications of unemployment.

So Then, What Should the UK Chancellor Do Now?

Some argue there is very little that the Chancellor can do, when in fact there is plenty she may attempt to do. The proposed Autumn Budget (her second such attempt to re-balance government spending) will have limited economic effects; the Chancellor can, of course, choose to reduce national insurance contributions, propose to lower the commitment to uphold various taxes surrounding the operation of running a business, and to alleviate the cost of employment. This may work to increase the vacancy rate and therefore shift the future labor market employment level, but these may have very limited effects, especially against the headwinds of a relatively high level of interest rates, which hover at around 4% at the moment.

Just to put that in a geo-political context: The FTSE 100 is at an overwhelming 9,899.60 this morning, CPI was up 3.8% yoy in September, and West Texas Intermediate is currently 60.94 (Good economists may use the CPI/WTI spread and pass-through as an effective proxy for inflation dynamics and as a gauge for international economic shocks). Comparatively, the unemployment in Europe is 6.0% on average. Ahead of next year's 52nd G7 Leaders' Summit in France, where Finance Ministers will no doubt be gloating over their respective situations, you have to wonder whether a progressive policy on tax is still the right way to go for Chancellor Reeves.

Shameless Plug - Concurrent Research Projects +1

What else am I up to at the moment? Well, I am currently applying for doctoral studies, which I will be resuming sometime after completing the programme I am currently on at The Open University, and I am subsequently working on several concurrent independent projects, which have emerged as opportunities to enhance knowledge and research into public policy from a labor market perspective. All of my projects can be found in the links at the top of my OU Personal Blog.